SASKATOON MADE

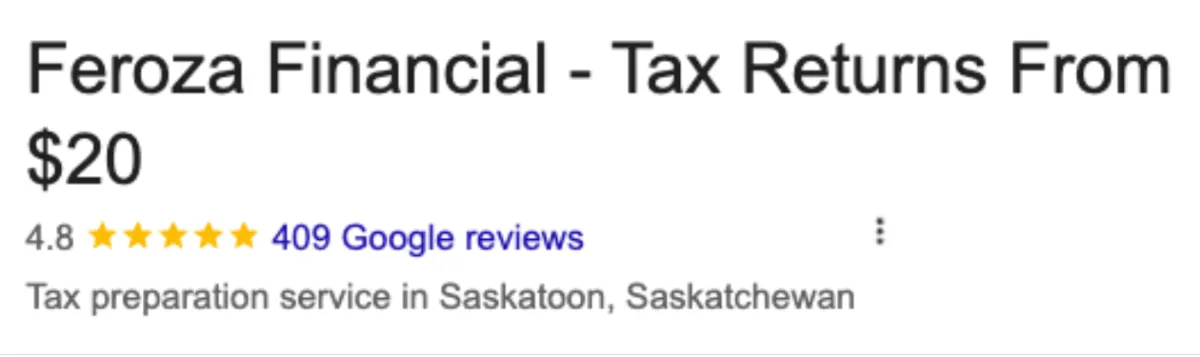

10,000+ personal clients, 350+ business clients, and over 400+ reviews

10,000+ personal clients, 350+ business clients, and over 400+ reviews

Maximize Your Financial Success with

Feroza Financial

Call now to claim your

Personal Tax Returns

for as low as

$20

Call now

To Claim Your

Personal Tax Returns

For As Low As

$20

Maximize Your Financial Success with

Feroza Financial

Corporate

Tax Returns

Free Consultations

Drop off and skip the line

Personal

Tax Returns

$20

From

Drop It Off And

Skip The Line

OWN A BUSINESS?

Late? Personal Tax Returns

Personal Tax Returns

$20

From

Personal Tax Returns

$20

Corporate

Tax Returns

$20

From

From

Drop It Off And

Skip The Line

Free Consultations

Drop off and skip the line

Drop It Off And Skip The Line

Call us to save now!

Late? Personal Tax Returns

Personal

Tax Returns

$20

From

OWN A BUSINESS?

We've served Saskatchewan for 10+ years

Corporate Services

TAX Returns

Bookkeeping

Accounting

Payroll

We've served Saskatchewan for 10+ years

Corporate Services

TAX Returns

Accounting

Bookkeeping

Payroll

Your One-Stop Financial Solution

Our firm has Served over 350 businesses & Helped save thousands per year in our 13 years in business!

Helping you Do

the money thing right

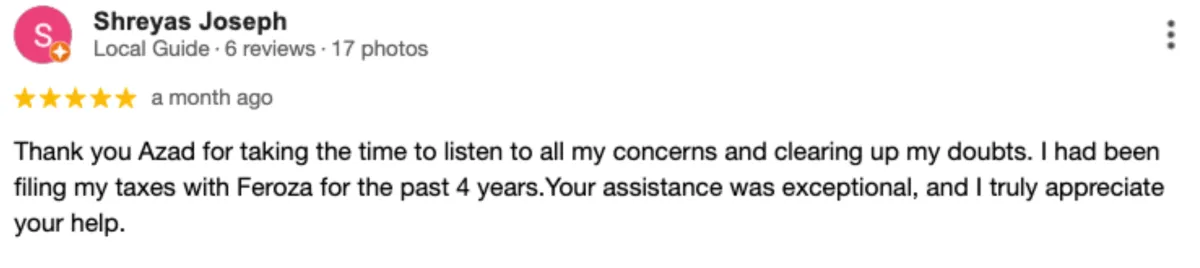

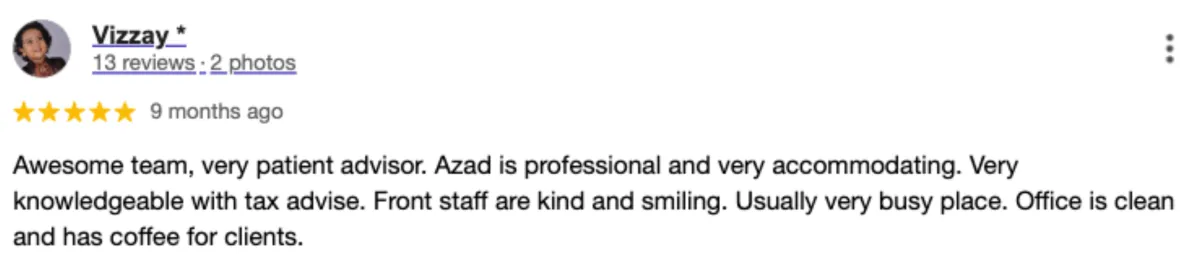

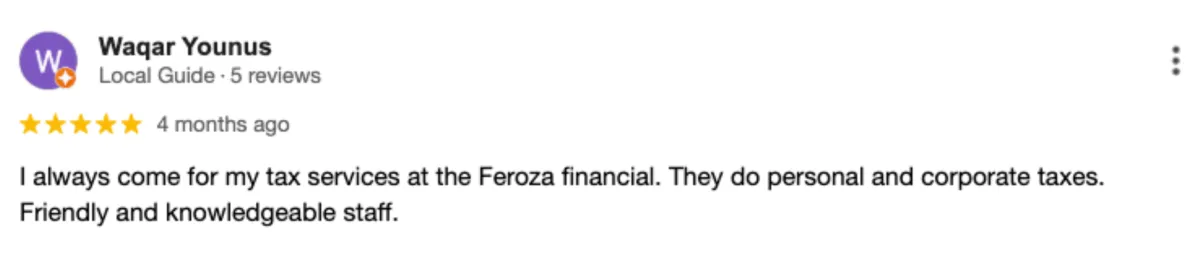

Testimonials

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Jane Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

John Doe

Got Questions?

What is the free consultation for businesses?

Our free consultation will require you to come visit one of our branches with necessary documents regarding your business income, expenses, and statements. We will then provide you with options and quotes.

Once you agree to a comfortable price, we will complete the work over 1-2 weeks. You can call anytime for an update on your work. No work will be submitted to the CRA at this point.

We will then have a follow-up appointment where we review the completed work with you, addressing any concerns and questions. Once you are satisfied, we will then submit your return.

How much is a business tax return?

The cost of a business tax return can vary significantly based on several factors, including the complexity of your business structure, the volume of transactions, the industry you operate in, and the completeness of your financial records.

Generally, more intricate businesses with numerous transactions and specific industry regulations will require more time and expertise, leading to a higher fee compared to simpler business structures.

We will provide you with a quote during your free consultation. No work will be proceeded until you are happy with the price. We aim to charge less than all competitors.

What documents do I bring to you as a business owner?

Personal Information:

Social Insurance Number

Valid Government ID

VOID Cheque (If first-time filing)

Permanent Residence Card (If PR)

Business-Related Information:

All income numbers and records for your business (e.g., invoices, sales summaries, revenue statements).

All expense records related to your business operations (e.g., receipts, bills, contracts).

Business bank statements for the relevant tax year.

Details of any assets and liabilities related to your business.

Information about any business deductions you plan to claim.

Details of any government remittances made (e.g., GST/HST, payroll deductions).

Any prior year tax returns and related notices of assessment for your business. Information about your business structure (e.g., sole proprietorship, partnership, corporation).

If incorporated, your corporate documents and financial statements.

Having this information readily available will allow our tax professionals to provide you with the most accurate assessment and quote during your free consultation.

Tip: Have documents related to your finances that aren’t mentioned here? Bring them with you just to be safe!

How do drop off services work?

Business Clients:

When you arrive for your free consultation with our tax professionals, we will look over your documents and determine what you need from us. Once we confirm your service request and agreed price, we will collect all your documents.

Over the next 1-2 weeks our team will proceed to complete all your requested work. At any time you can call or visit our office to follow up on the progress.

Once we are done, and before any submission occurs, we will do a follow-up consultation. In this appointment, all completed work will be discussed and confirmed. Once you are satisfied, we will then collect payment and submit your return.

Personal Clients:

Our accountants will collect all your information and necessary documents when you first come to the office.

Over the next day or two we will finish most of the inputting work and give you a call for an interview.

When you arrive, a professional accountant will break down your tax refund before officially submitting the file to the CRA.

This way, you are able to avoid lengthy wait times and have the ability to speak to an accountant before we file.

What kind of businesses have you worked with?

Personal Information:

Law Firms

Medical Clinics

Construction Companies

Engineering Firms

Real Estate Firms

Cleaning Companies

Restaurants and Food

Services Retail Stores

Transportation and Logistics Companies

Manufacturing Businesses

Technology Startups

Marketing and Advertising Agencies

Automotive Repair Shops

Dental Offices

Farming and Agricultural Operations

What if I am self-employed?

If you are self-employed, your business income and expenses are generally reported on your personal tax return. For the 2024 tax year, the filing deadline for self-employed individuals is June 16, 2025 (since June 15th falls on a Sunday). However, any tax owing is still due by the regular personal tax deadline of April 30, 2025.

When you come in for your free consultation, please bring the same information that is listed for personal tax filing. This will allow our tax professionals to accurately assess your business income and expenses and ensure all necessary forms are completed correctly for your self-employment tax return.

How do I file a personal tax return?

Our accountants will collect all your information and necessary documents when you first come to the office.

Over the next day or two we will finish most of the inputting work and give you a call for an interview.

When you arrive, a professional accountant will break down your tax refund before officially submitting the file to the CRA.

What documents do I bring for personal tax filing?

Personal Information:

Social Insurance Number

Valid Government ID

VOID Cheque (If first-time filing)

Permanent Residence Card (If PR)

Employment & Income Info:

Employment Income (T4 Slip)

Tuition/Education (T2202A)

Rental Property Income Info

Expenses:

Medical Bills

Charitable Donations

Professional/Union Dues

Rent/Property Taxes Paid (Ontario)

RRSP Contribution Receipts

Family & Children:

Dependents' Info (Name & SIN)

Spouse/Common-Law Partner Info (Net Income, SIN, Marital Date)

Childcare Expenses

Children’s Arts & Sports Program Expenses

Adoption Expenses

Government Benefits:

Employment Insurance (T4E Slip)

Universal Child Care Benefit (RC62)

Old Age Security/CPP (T4A-OAS, T4AP)

Other Pensions & Annuities (T4A)

Social Assistance/Worker’s Compensation (T5007)

Investments:

Investment Income Statement (T5)

Trust Beneficiary/Mutual Funds (T3)

Bank Statement for RRSP (T4RSP)

Interest, Dividends, & Mutual Funds (T3, T5, T5008)

Tip: Have documents related to your finances that aren’t mentioned here? Bring them with you just to be safe!

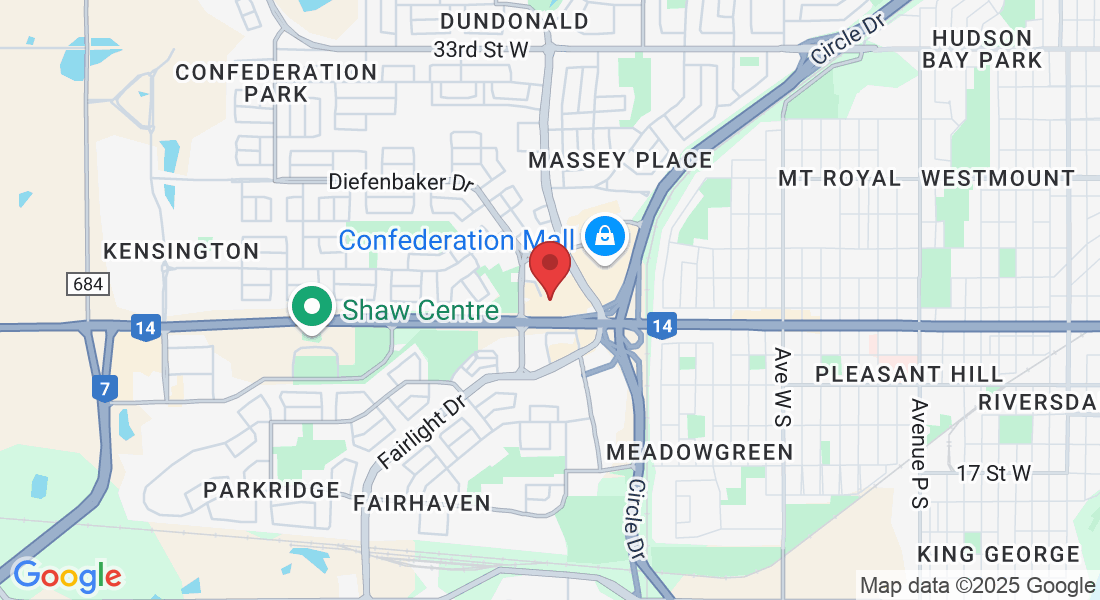

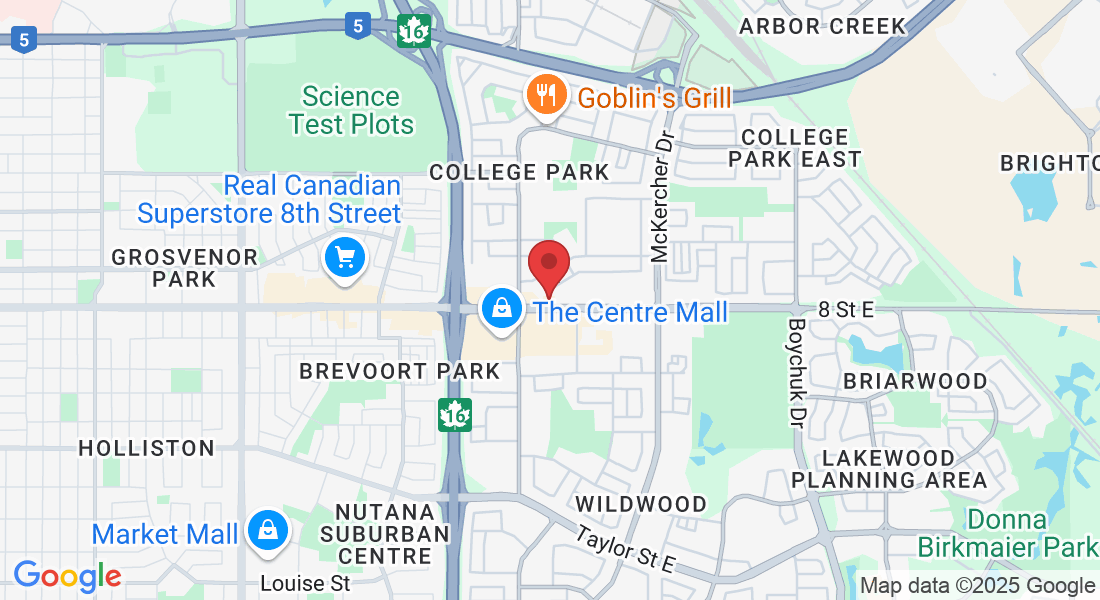

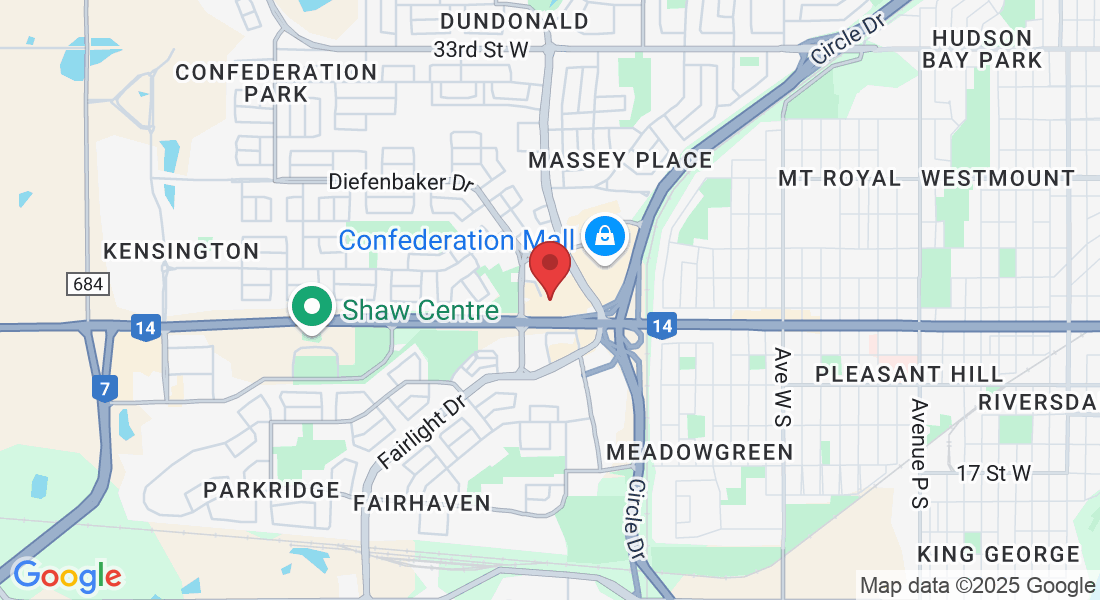

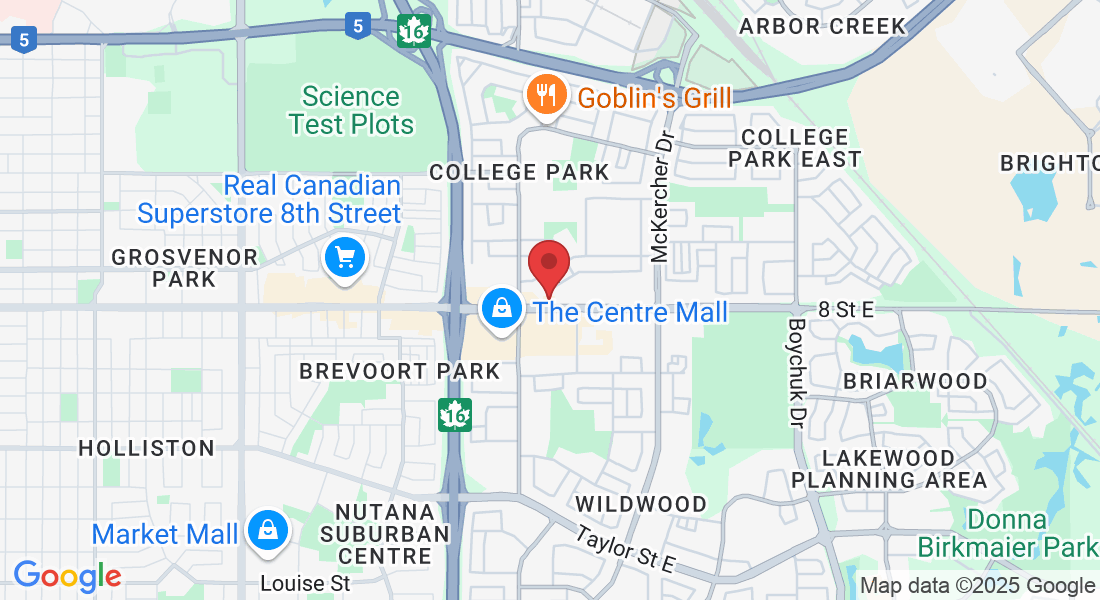

Are you a local business? (About Us)

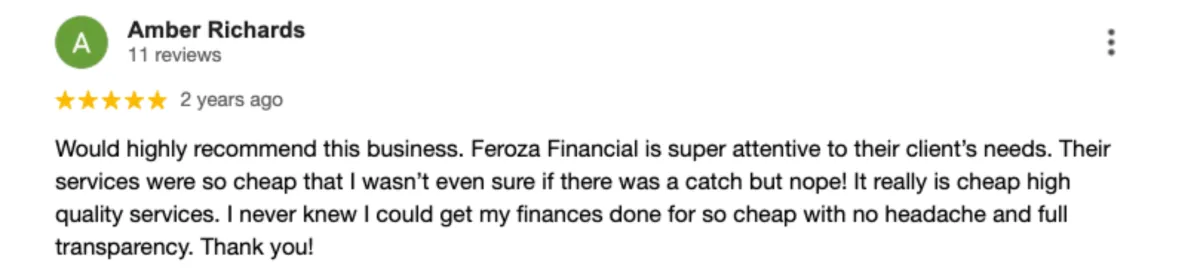

Feroza Financial is a Canadian finance firm founded in Saskatoon, Saskatchewan. We specialize in accounting, tax, and insurance services. We proud to have served over 350 local businesses here in Saskatoon!

Established in 2010 as an affordable alternative to costly financial services, we have proudly helped thousands of Canadians access high-quality financial support at a lower price point compared to our competitors.

After 15 years in business, we continue to uphold our principles of affordability and excellence, ensuring Canadians keep more money in their pockets while receiving better advice on how to manage it.

Want us to contact you instead? Fill out the form below

Want us to contact you instead? Fill out the form below

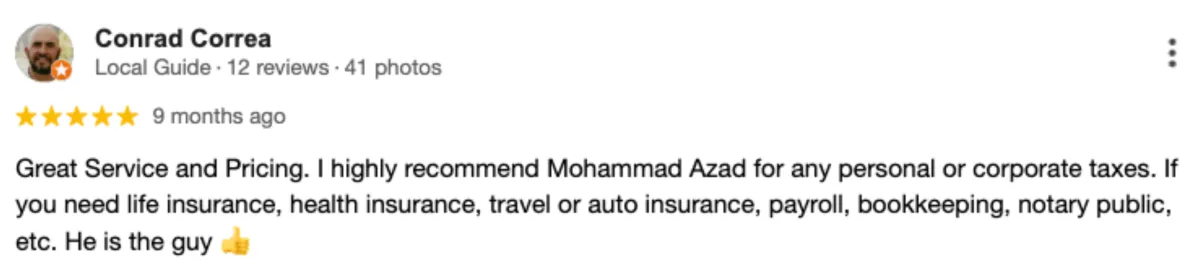

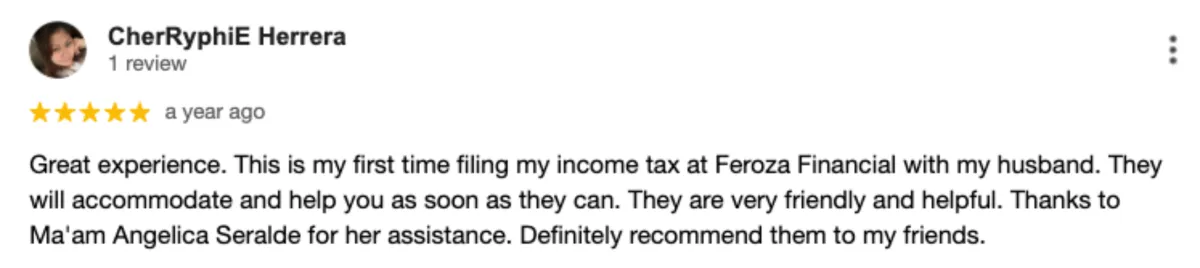

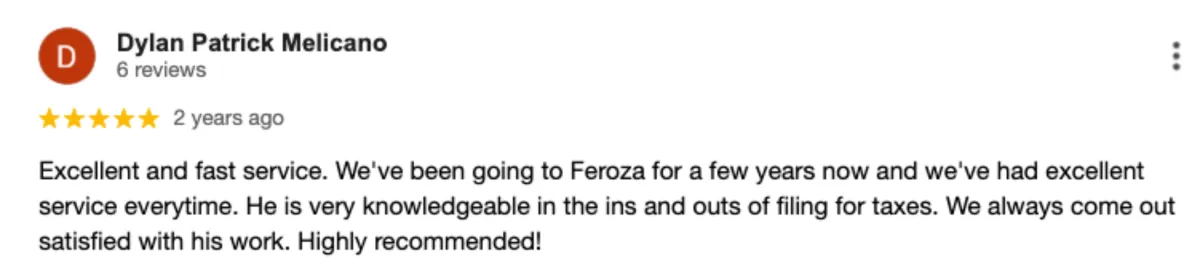

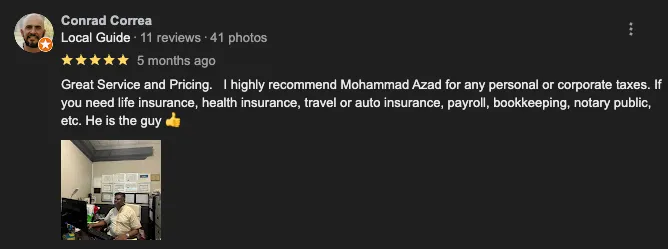

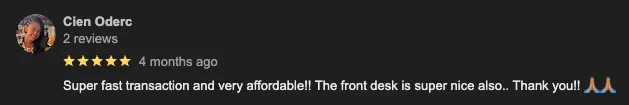

400+ Reviews

400+ Reviews

SEE WHAT SASKATOON HAD TO SAY ABOUT US

SEE WHAT SASKATOON HAD TO SAY ABOUT US